Thank you for reading Observing Japan. This post is available to all readers.

If you are looking for timely, forward-looking analysis of the stories in Japans’s politics and policymaking that move markets, I have launched a new service through my business, Japan Foresight LLC. For more information about Japan Foresight’s services or for information on how to sign up for a trial or schedule a briefing, please visit our website or reach out to me.

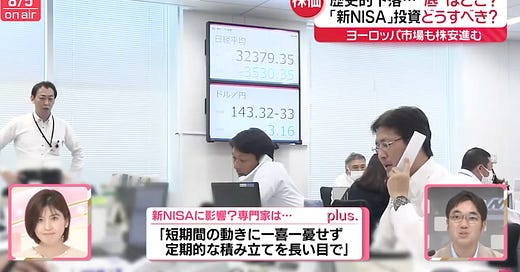

The Nikkei 225 lost 12.40% on Monday, 5 August, its worst day ever, surpassing its previous worst, which was Friday, 2 August. The stock market declines – which also included a more than 12% decline in the broad TOPIX index – surpassed 1987’s “Black Monday” and have led some to refer to Monday as the “Black Monday of the Reiwa Era.” The index erased its gains for the year, as investors raced to reduce their risk exposure. The yen, meanwhile, briefly climbed to JPY 141/USD. The speed and scale of these market movements in Japan alone are difficult to wrap one’s mind around, so I thought it would be useful to collect some links to how the latest Black Monday is being discussed in Japan.

The Kishida government itself is responding cautiously. Chief Cabinet Secretary Hayashi Yoshimasa said on Monday that “we are closely watching the movements of markets at home and abroad with a sense of nervousness” and “it is important for the government to make decisions with a cool head.” Finance Minister Suzuki Shunichi shared a similar statement, and added a message of investors who may be new to investing thanks to the Kishida government’s efforts to democratize financial asset ownership, “Even in the midst of market volatility, including market crashes, please make calm decisions that take into consideration the importance of the long term, of savings, and of diversified investments.” (It was only Friday that Prime Minister Kishida Fumio spoke at an event to promote financial literacy about his government’s efforts to make Japan an “asset management power.”)

Japan’s opposition parties are already trying to make the market volatility costly for the government, with Constitutional Democratic Party leader Izumi Kenta’s calling for a recess meeting of the lower and upper house budget committees to address Bank of Japan (BOJ) Governor Ueda Kazuo’s and the government’s thinking on interest rates and Democratic Party for the People leader Tamaki Yūichirō describing the BOJ’s decision to raise interest rates last week as “awful.” Analysts – and the right-wing press – are already talking about the market selloff since the 30-31 July BOJ meeting as the “Ueda shock.”

Ironically, while Bank of Japan Governor Ueda Kazuo is already being blamed for the market volatility, an NHK poll conducted 2-3 August found that 54 percent of respondents greatly (11 percent) or somewhat (43 percent) approved of the BOJ’s decision to raise interest rates to 0.25 percent, compared with 32 percent who were completely (eight percent) or somewhat (24 percent) opposed. (These figures might look different if the poll were conducted today, so it will bear watching future polls.) An NHK explainer of the selloff lists Ueda’s aggressive stance on monetary policy normalization as only one of four causes of Monday’s movements. Mainichi, meanwhile, quotes economist Kumano Hideo at the Dai-Ichi Life Research Institute as saying, “If the BOJ had given markets time to adjust the yen carry trade, the yen would not have appreciated and stocks would not have fallen as much as we have seen thus far.”1

After months of political handwringing over the weak yen and its impact on households, the yen’s surge over the past week now has large exporters anxious about yen strength (and the overall health of the US economy). The Nikkei Shimbun’s editorial in its Tuesday edition gently accuses the government and BOJ of mishandling the situation. “Although the authorities' efforts to correct the yen's weakness were appropriate, it is undeniable that they have spurred a reverse flow of international money and increased market volatility. We hope that the government and the BOJ will pay close attention to the impact on business activities and take all possible measures to communicate with the market, in order to stabilize it.”

Meanwhile, the Asahi Shimbun considered the impact market volatility will have on Kishida’s pursuit of a second term as leader of the Liberal Democratic Party (LDP). While an anonymous source close to the prime minister is quoted as saying that the economy is stable and they are not greatly worried about “panic selling,” other sources expressed concerns that these developments could undermine Kishida’s using his stewardship of the economy as key argument for his reelection. An unnamed member of the Asō faction said, “Economic policy, the strong point of the Kishida administration that had been highly regarded by the public, has been lost. The Kishida administration increasingly has its back against the wall.” Whether Kishida’s rivals within the LDP take advantage of the market panic – and whether LDP Secretary-General Motegi Toshimitsu and Digital Affairs Minister Kōno Tarō, who both called for interest rate hikes before the BOJ’s meeting, also pay some political price – remains to be seen.

I find it a little odd that Ueda was not asked about the carry trade at his press conference last week.